Is Medicare Supplement Insurance A Good Idea?

Deciding whether Medicare supplemental insurance, also known as Medigap, is a good idea depends on your individual healthcare needs, financial situation, and preferences. Let’s explore the factors to consider:

Understanding Medicare and Medigap

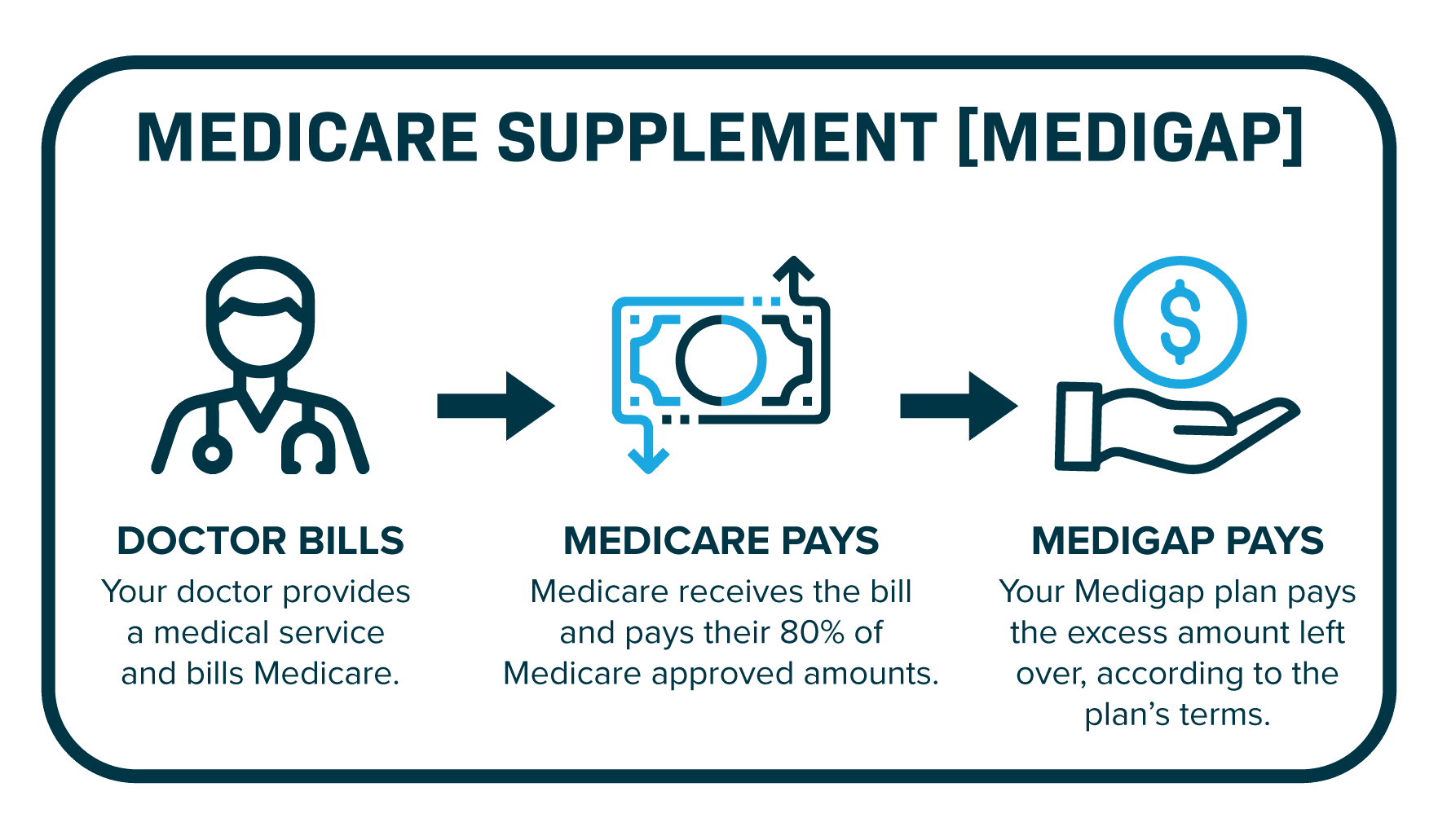

Firstly, Medicare is a federal health insurance program primarily for individuals aged 65 and older, as well as certain younger people with disabilities. While Medicare covers a wide range of medical services, it doesn’t cover all healthcare costs. This is where Medicare supplemental insurance, or Medigap, comes into play.

Reasons Why Medigap Might Be Beneficial:

- Coverage of Medicare Gaps: Medicare consists of Part A (hospital insurance) and Part B (medical insurance). While these parts cover many healthcare services, they also come with deductibles, copayments, and coinsurance costs that beneficiaries are responsible for. Medigap policies are designed to fill these gaps by paying for some or all of these out-of-pocket costs, depending on the specific Medigap plan you choose.

- Predictable Costs: Medigap plans offer financial predictability by helping you budget for healthcare expenses. Once you pay your Medigap premium, it can help cover Medicare costs that would otherwise fluctuate based on your medical needs. This can be particularly reassuring for those on fixed incomes or who prefer to have consistent healthcare expenses.

- Choice of Providers: Unlike some Medicare Advantage plans, which may have networks of providers, Medigap plans generally allow you to see any healthcare provider nationwide who accepts Medicare patients. This flexibility can be valuable if you have established relationships with specific doctors or specialists.

- Travel Coverage: Some Medigap plans include coverage for healthcare services received outside of the United States, which can be beneficial for retirees who travel internationally.

- No Referrals Needed: With Medigap plans, you typically don’t need referrals to see specialists. This can streamline the process of accessing specialized medical care if and when you need it.

When Medigap Might Not Be Necessary:

- Already Covered Expenses: If you have additional coverage through an employer, union, or Medicaid that already pays for most of your out-of-pocket Medicare costs, Medigap may duplicate coverage you already have.

- High Cost for Low Usage: If you rarely use healthcare services and are comfortable with the potential out-of-pocket costs associated with Medicare, the premiums for Medigap plans may outweigh the benefits.

- Pre-existing Conditions: Medigap plans may not cover pre-existing conditions during the waiting period if you don’t enroll during your initial enrollment period or a special enrollment period. In such cases, you may want to carefully weigh the cost versus the potential benefits.

How to Decide if Medigap is Right for You:

- Evaluate Your Healthcare Needs: Consider your current health status, how frequently you expect to use healthcare services, and any specific medical conditions you have. This assessment can help determine whether Medigap coverage would be beneficial in reducing your out-of-pocket expenses.

- Compare Plan Costs and Coverage: Medigap plans are standardized in most states, with each plan labeled by a letter (e.g., Plan F, Plan G). Plans of the same letter offer the same benefits, but premiums can vary by insurer. Compare the costs and coverage details of different plans to find one that fits your budget and healthcare needs.

- Understand Enrollment Periods: The best time to enroll in a Medigap plan is during your Medigap Open Enrollment Period, which starts when you’re 65 or older and enrolled in Medicare Part B. During this period, you have guaranteed issue rights, meaning insurers cannot deny you coverage or charge higher premiums due to pre-existing conditions.

- Consult with a Medicare Advisor: Insurance can be complex, and a Medicare advisor or financial planner specializing in Medicare can help you navigate your options. They can provide personalized advice based on your health needs and financial situation.

Conclusion

Medicare supplemental insurance can provide valuable financial protection and peace of mind by covering some or all of the out-of-pocket costs associated with Original Medicare (Parts A and B). Whether it’s a good idea for you depends on your individual circumstances, including your health status, budget, and preferences for healthcare providers. By carefully evaluating your options and understanding the costs and coverage of Medigap plans, you can make an informed decision that aligns with your healthcare needs during retirement.